How to Pick Quality Investments

NOTE: This article explains a few investing concepts, but is not intended nor should it be taken as investing advice. All investments have some risk of loss and investors should proceed with caution.

Most people think that “investing” is only about trading stocks, but if you have a retirement plan through your employer or an IRA, you are an investor too! To get the most of your savings in retirement accounts, it is necessary to pick investments that are low cost and perform well over time. If you invest in quality choices, you can just check your performance once a year and watch your money grow.

Before we jump in to how to choose a quality investment, your Smart Sister wants to remind you that starting to invest is actually a two-step process. First you pick the type of account you want to open – such as a Roth IRA or a Brokerage account – and then you need to select investments to buy with the money you add to the account. Here are some other blog posts about 401ks and IRAs to learn more about tax advantaged investing.

This article will focus on how to choose a good mutual fund as most employer retirement plans are limited to mutual funds. We will discuss how to pick and trade stocks in future articles.

What is a Mutual Fund?

Mutual funds became more widely used in the 1960s and 1970s to make investing less risky and more accessible for the individual investor (like you and me!). A mutual fund is a collection of underlying investments (like stock in public companies, US Treasury bonds or corporate debt) that are bundled together for sale. When you buy a share of a mutual fund, you buy a piece of all of the underlying investments. If you buy $500 of Apple stock, your investment is 100% tied to how Apple performs. If you buy $500 of the S&P 500, you will buy a piece of Apple, but also the 499 other US companies that Standard & Poor’s (an independent rating agency) has determined are the biggest.

Mutual funds lower your risk as they are diversified across many investments. You can lower your risk further by buying mutual funds across different industries (or sectors) of the stock market as well as buying mutual funds that cover different sized companies and a range of geographies.

Know Your Appetite for Risk

All investments can lose money, so anytime you start to invest, it is important to understand your timeline, risk tolerance or ability to absorb losses. The more you spread your investments across different parts of the market, the better chance your money will grow year in and year out.

Time is also a crucial factor. The longer you have to invest (such as 20 years until retirement) the better chance you have that your money will grow exponentially.

You can use this Risk Quiz to understand your own timeline and risk tolerance. Remember there are no right or wrong answers… you want to understand what you are comfortable with so that you can stay invested through any ups and downs of the market. Just because your friend is into crypto and your financial advisor uncle thinks that energy stocks are the future does not mean that they are right for you.

Diversify Across Your Investments

Diversification is a fancy way of saying “spread your money around”. Just because Apple has performed well in the past does not mean that it will do so in the future. The more that you are invested across companies, industries and geographies, the better chance that you will own the next Apple or Nvidia.

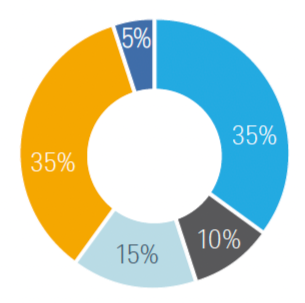

Page 4 of the Schwab Risk Quiz provides some model portfolios (also known as asset allocations) based on your answers to the two sections of the quiz. These are just guidelines – you do not need to follow them rigidly. The point of these portfolios is to demonstrate how to diversify. If you are a Moderate investor and you have $5,000 to invest, you may choose a portfolio that looks like this:

Moderate Allocation

$2,000 = 40% US Large Cap

$750 = 15% International

$500 = 10% US Small/Mid Cap

$1,750 = 35% Bonds and Fixed Income (including Intl Bonds)

How to Choose Mutual Funds

Now that we know how we are going to allocate our cash across different investment types, we need to pick some mutual funds. The two questions you want to ask yourself are:

1) How much am I going to make on this investment

2) How much is it going to cost me?

If you log into your employer’s 401k account, you will find a list of investment choices. They will be arranged by asset classes (US Large Cap, US Small Cap, US Mid Cap, Bonds, International, etc.). Only compare investments in each category against one another; it is not realistic to expect a Bond fund to perform like a Stock fund.

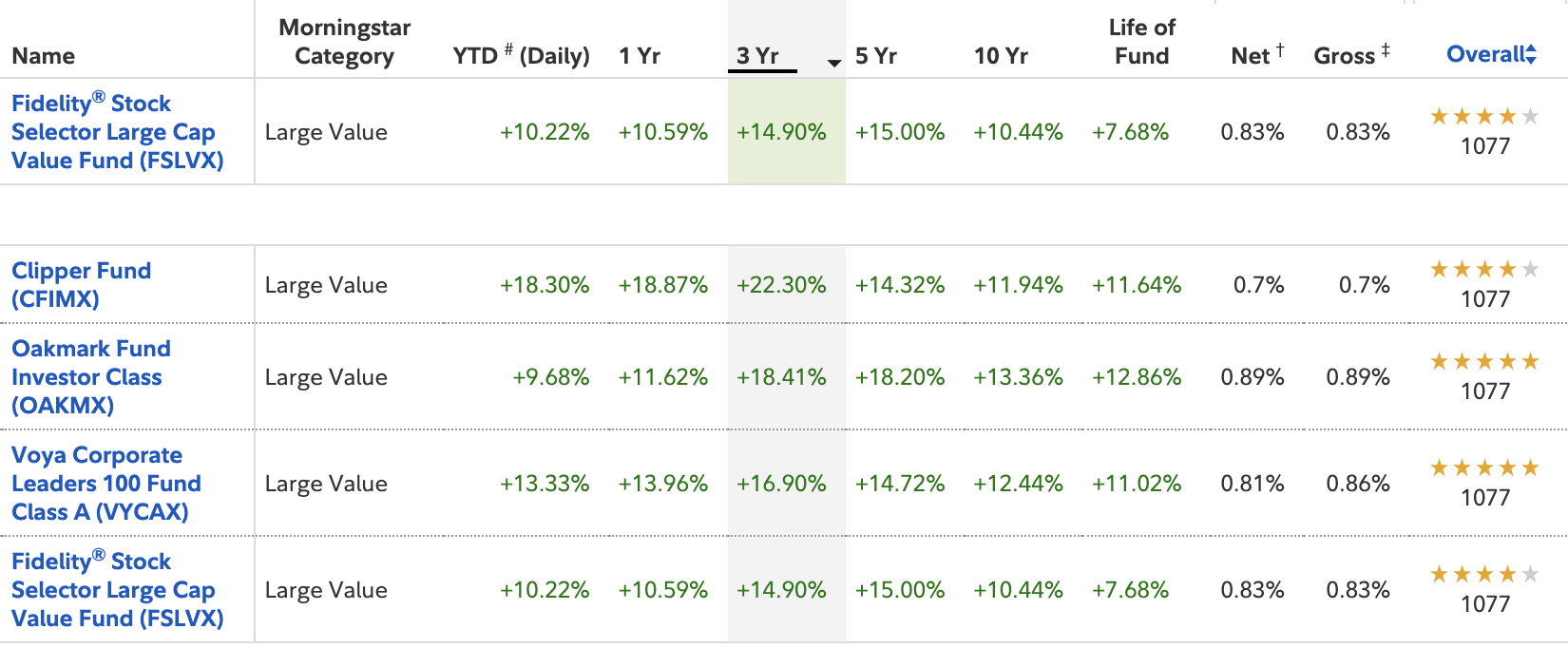

To determine “how much am I going to make on this investment?”, review a category in your 401k such as US Large Cap investment choices and compare the 3 or 5 year returns to find the one that has done the best. To then understand “how much is it going to cost me?”, look at the Gross Expense Ratio (the administrative fee for the fund) and see which one is the lowest. Sometimes the right choice is not the highest return, if the Gross Expense Ratio is also high. At the most basic level, you want to balance performance and fees while making the right choice for you.

As an example, a few US Large Cap Value choices from Fidelity are listed below. Fidelity is (of course) highlighting their best fund in the category, but all 4 of these choices look good. You might want to choose the Clipper Fund for its consistent high performance and the lower Gross Expense Ratio. The mix of investments within your employer retirement plan or your own accounts will be different - this is simply an example and not investment advice!

It is important to look at longer term performance to know that the mutual fund you wish to buy performs well year in and year out. Remember you are investing for the long term and you don’t want to worry about a volatile investment that you will have to check all the time. Don’t chase YTD performance - buy quality and stick with it.

All mutual funds charge a Gross Expense Ratio and you want to seek out a fund that is low cost but still performs. It’s okay to pay a little more if the fund does several percentage points better than its peers. As a rule of thumb keep the Gross Expense Ratio under 1%.

What Does “Large Cap” Mean?

The financial industry is high regulated and has established some ways of classifying investments so that investors know what kind of investments are inside the mutual fund. The term “Large Cap” means large market capitalization; it has nothing to do with the revenue or the profitability of the company. The stock price of every public company is influenced by us, the “retail investors”. When we get excited and start buying Game Stop, or we worry about Apple’s ability to keep selling more iPhones and sell AAPL, it affects the daily stock price and therefore the market capitalization.

Market capitalization is determined by multiplying the company’s shares outstanding by the share price on any given day. On September 15th of this year, Amazon’s share price was $219 and its market capitalization was $2.34 trillion.

Large Cap is any company with a market capitalization over $10 billion. As you can see, AMZN is way over that. So is Nvidia, Apple, Microsoft, Meta, Google and Tesla. These seven companies dominate the US stock market – when they do well, all is good. But when they don’t do well, it can pull the whole stock market with them. As you pick quality investments, it is important to understand your exposure to the “Magnificent Seven” and make sure you have mutual funds that cover other investments like Small and Mid-Cap companies or Bond funds.

Conclusion

Investing does not have to be complicated. Within your employer retirement plan or your own IRA, research mutual funds available by asset class and pick the ones that do well over time with the lowest fee. Remember that you are comparing:

1) The 3 or 5 year return of the mutual fund to its peers in the same asset class (i.e. US Small Cap)

2) The Gross Expense Ratio of the mutual fund

Using the asset allocation pie chart above, you could pick as few as 4 investments – one for each asset class. Once you have invested all your cash in the account, you can ignore it until your annual review process. If you have diversified well and made good choices, you don’t need to check your account or get stressed about the ups and downs in the stock market. No matter what is happening in the broader economy, you should have at least one investment that will grow at every part of the economic cycle.

Go live your life and let time do the work!