Time is on Your Side... When Investing

It's been an incredibly tough year for investors in 2022, but remember...

This is a marathon, not a sprint.

Slow and steady wins the race. You will be rewarded for time in the stock market, so just stick with your savings and investing schedule. Remember you have 10, 20 or 30 years before you need to tap your retirement savings, so do everything you can to let it grow, Sister!

Downturns can feel overwhelming and could cause panic. Studies show that investors who cash out during times of volatility and reinvest when the market recovers fall further and further behind their peers who just wait it out. We get it - when you are seeing red in your accounts, it’s really hard to do nothing.

So, how can you ignore the noise?

1) Don’t look at it. This is simple advice, but really important for the average investor. If your retirement is decades away, there is no need to check your positions week to week. Understand your risk tolerance, invest in a range of quality investments and keep focused on the long term. Smart Sister Finance recommends a bi-annual portfolio review to analyze all of your accounts and check progress on your goals. Other than that, let time do it’s thing.

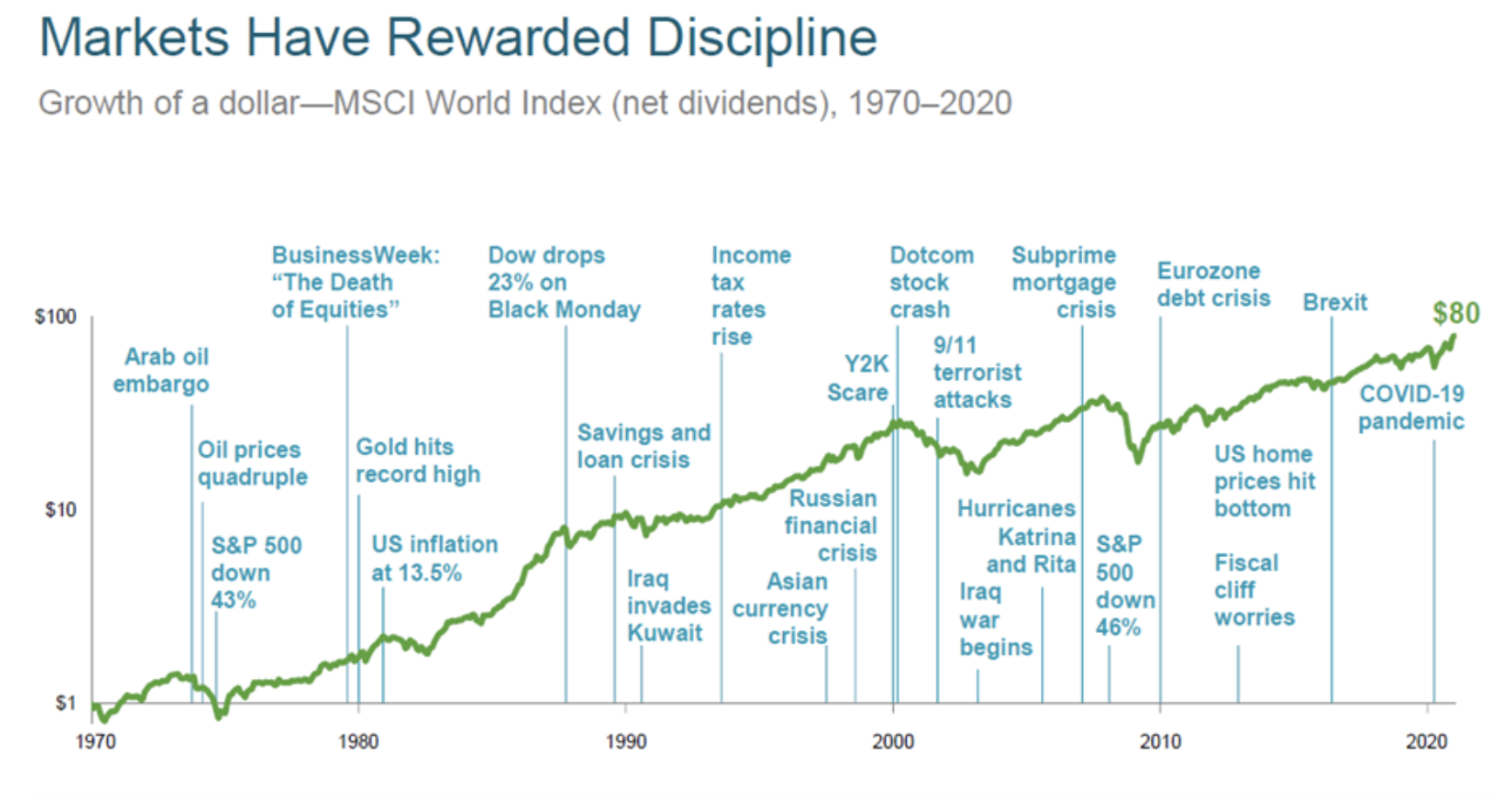

2) Get some long term perspective. Yes, there have been corrections in the stock market this year due to rising interest rates, Russia’s invasion of Ukraine and the continuing labor and supply chain shortages that have affected the economy throughout the pandemic. While this feels like a perfect storm, we have weathered this all before. Looking back over the last 50 years using the chart below, there have been many times of global uncertainty and economic shocks that have caused temporary setbacks. Each time, the economy has recovered and grown stronger and that cycle will continue.

3) Make a small move first. If you must sell an investment during a downturn because something has fundamentally changed with a company’s or an industry’s outlook, sell a small portion of your holding to start. You can also place a series of limit orders at your desired sell prices to start to draw down your position at one price, or sell all if it recovers to a higher price.

4) Trust in compound growth. If you have taken a Smart Sister Finance class, you know we love this compound interest calculator. Compound interest is what happens when all of the interest, dividends and capital gains for an investment are reinvested in the initially selected mutual fund, ETF or stock. Your account keeps growing and reinvesting and growing and reinvesting month after month and year after year. Check your accounts and make sure the option to “reinvest dividends and capital gains” is selected for your investments (this happens automatically in 401k accounts). Once you have done this, you can rest easy because you are making money while you’re sleeping!

Still feeling uneasy? Let’s talk about it. Smart Sister Finance offers customized coaching on a range of topics including investing. We can help you understand personal risk tolerance, build an investment portfolio with quality investments and feel money confident about reaching your life goals.

.

Bridget Jones founded Smart Sister Finance on the truth that money confidence unlocks life choices. Smart Sister Finance offers customized one-on-one coaching and online group events to ensure that every precious, hard-earned dollar has a purpose and is used to the best advantage in life. Join the community of smart sisters @SmartSisterFinance.